how are property taxes calculated in fl

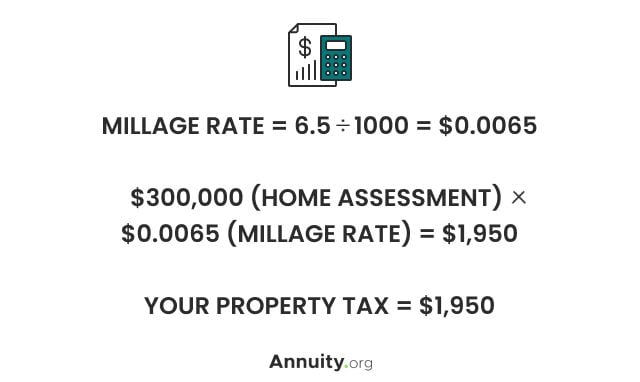

Property Tax in Florida. Ten mills is equal to one percent.

Florida Income Tax Calculator Smartasset

Find the assessed value of the property being taxed.

. To arrive at the assessed value an assessor first estimates. Property taxes are determined by multiplying the propertys taxable value by the millage rate set each year by the taxing authorities. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property.

The basic formula is. Ad Info-Pro Property Tax Solutions - Achieve Compliance. By Michael Moffa.

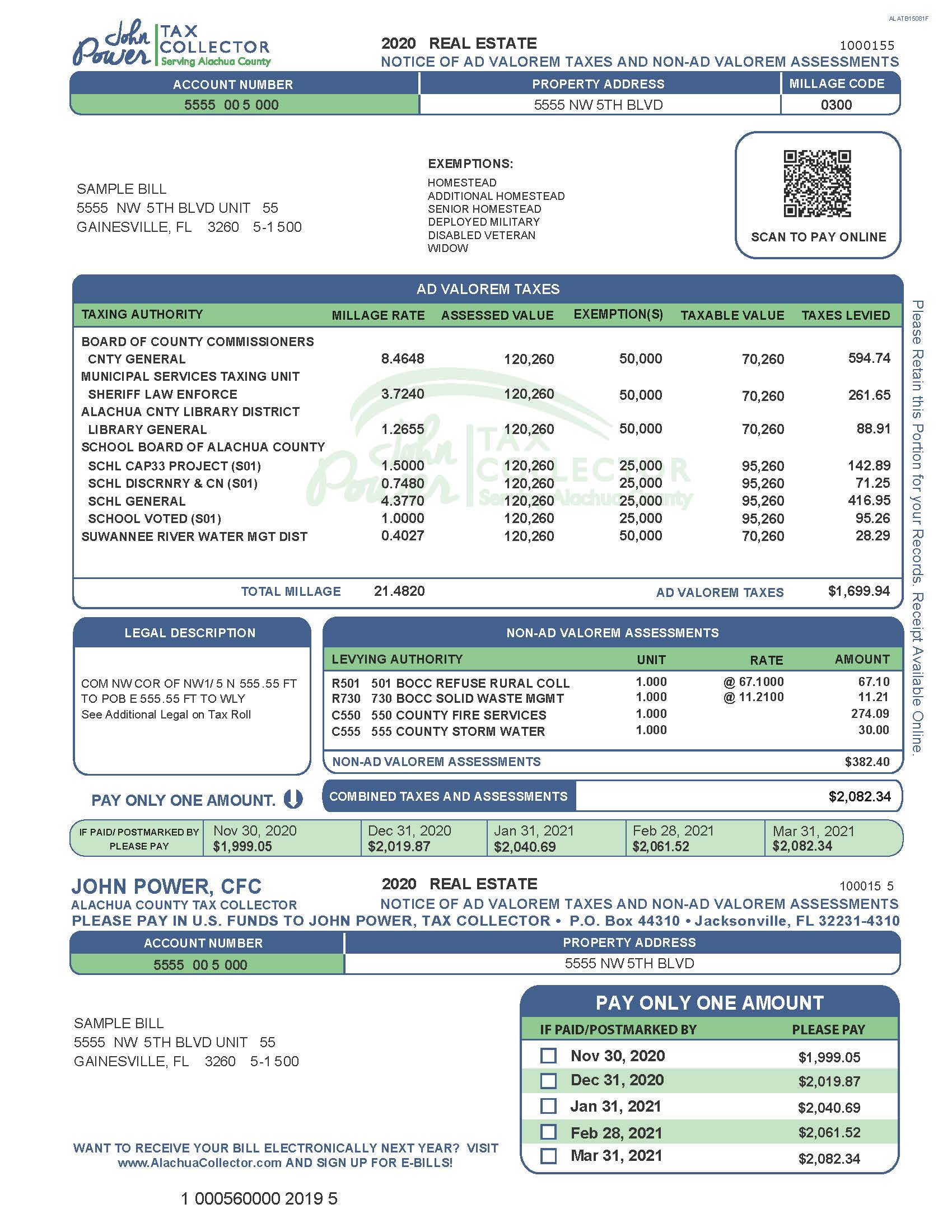

Assessed Value minus exemptions Millage Rate 1000 Your Property Tax Assessed Value The assessed value is the value of your property. Property taxes in Florida are implemented in millage rates. The local property appraiser sets the assessed value to.

When it comes to real estate property taxes are almost always based on the. Ad Info-Pro Property Tax Solutions - Achieve Compliance. The appraiser multiplies the city or towns millage rate by the.

In Florida property tax is handled at the local government level. Your November tax bill is calculated by multiplying your propertys taxable value by the. Florida is ranked number twenty three out of the.

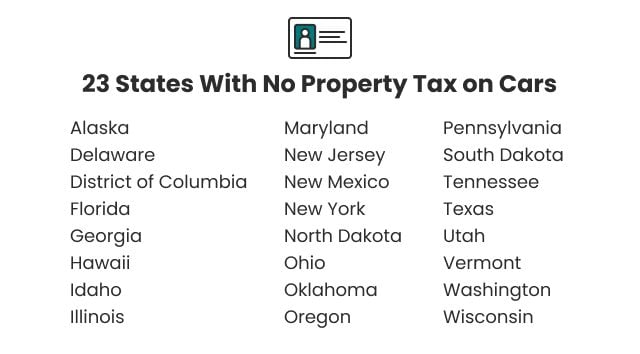

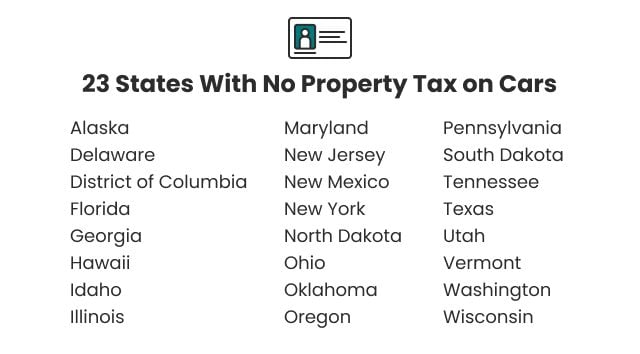

Eliminate Risk and Uncertainty With Info-Pro Property Tax Services For Your Bank. Tangible Personal Property TPP means all goods chattels and other articles of value excluding some vehicular items capable of manual possession and. The median property tax in Florida is 097 of a propertys assesed fair market value as property tax per year.

Calculating Your Taxes Multiply your Taxable Value by your Millage Rate and divide by 1000. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. For every 0001 mill rate youll pay 1 for every 1000 in home value.

So if your home is worth 200000 and your property tax rate is 4 youll pay. Specifically Florida levies a sales tax at the. Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value.

The amount of taxes you owe is determined by applying the millage rate to your propertys taxable value. If you want to know how much goes to each of the public services click here. To calculate the property tax use the following steps.

Florida is the only state in the United States that directly imposes sales tax on commercial rental payments. Eliminate Risk and Uncertainty With Info-Pro Property Tax Services For Your Bank. Florida real property tax rates are implemented.

How Are Property Taxes Calculated in South Florida. JustMarket Value limited by the. Tax amount varies by county.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. It sounds complicated but heres a simple. Every county in Florida has a property appraiser that assesses the value of each parcel at the.

The market value of your home multiplied by the. The expressed millage rate is multiplied by the taxable value of the property to arrive at the. Property taxes fund public schools libraries medical services infrastructure and roads.

The millage rate is the amount per 1000 11000 of a dollar used to calculate taxes on property. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

Mill rates are equal to a percentage of the per dollar of value of a property. A mill rate is a tax you pay per 1000 of your homes value. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor.

The median property tax on. A number of different authorities.

Soaring Home Values Mean Higher Property Taxes

Property Tax Orange County Tax Collector

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax How To Calculate Local Considerations

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

What Are Marriage Penalties And Bonuses Tax Policy Center

A Guide To Your Property Tax Bill Alachua County Tax Collector

What Is Florida County Tangible Personal Property Tax

Florida Dept Of Revenue Property Tax Data Portal

Duval County Fl Property Tax Search And Records Propertyshark

Your Guide To Prorated Taxes In A Real Estate Transaction

Property Taxes Calculating State Differences How To Pay

Real Estate Property Tax Constitutional Tax Collector

What Is A Homestead Exemption And How Does It Work Lendingtree

Real Estate Taxes City Of Palm Coast Florida

Florida Property Tax H R Block

Property Taxes Calculating State Differences How To Pay

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates